Practical Resolutions: Making Your House a Home

Your home is a reflection of your tastes, your lifestyle and your ambition, and many of us are regularly transforming our homes one way or another to fit our adjusting needs. Whether it is refreshing a room to fit your style, reorganizing a closet to accommodate the holiday excess, going green to save the planet and a couple of bucks or a complete renovation of your kitchen- homes take maintenance. Some projects come about on a whim, but if you have any plans to make your nest nestier here are some ideas for not getting too overwhelmed by the process- no matter how large or small the changes you want to make:

Get Organized: Whether it is your closets, books, pantry or your entire basement identifying the problem is the first step. Once you know where to focus your energy think about the purpose your space should fulfill, what you want it to look like and how you can keep it organized for the long-term. Sometimes getting organized is a matter of doing a little bit every day, or it is finding the right storage solution. Once you know what the problem is you can identify your steps, timeline and budget. Ultimately, getting rid of the clutter and holding onto items you love the most and use will keep your spaces easy to manage year round.

Do a little every day: Everyone has a different method to managing home madness; some have a weekly cleaning routine, some focus room by room others pile everything in the closet until they have to deal with it. If you have a goal of getting rid of old possessions and clutter, remodeling your home office or keeping your home cleaner spend five to thirty minutes a day working to achieve your goal. Here is a good idea for keeping your home clean by doing a little every day, rather than spending your weekend playing catch up.

Beautification/ Gardening: This year my big goal is to finally start our edible garden, but I have been overwhelmed by all the steps- from finding the right containers for the garden, deciding what to plant, when to start the starts, etc. Each region has different gardening challenges; the plants that thrive in Seattle are different than Spokane or San Diego so if you are planning on a garden make sure you familiarize yourself with local resources that will give you advice specific to your area. If you have any landscaping projects, keep in mind advance planning is paramount to making this affordable, timely and sustainable. If you are planning on putting your house on the market eventually, make beautification a priority and plan your exterior in a way that will increase the curb appeal of your home in the future.

Home Improvement Projects: If you have an ongoing list of home improvement projects, make sure you have the right tools in your toolbox and prioritize and plan. You don’t want to spend every weekend working on dripping faucets so create a routine. When looking at the year ahead, think about seasonality of the projects. It is important to know when to ask for help from a professional in order to have repairs done right in the first place to avoid putting yourself at risk or the safety of your home.

Go Green: If your resolution this year is to save money and the planet by reducing your carbon footprint there are projects you can do large and small. Start with an energy audit, that way you know where your energy is actually being used- you may be surprised. Easy fixes start with replacing light bulbs with CFLs and buying energy cords that limit vampire appliances to use energy when they aren’t in use. If you are replacing your old appliances with newer energy efficient models, make sure you check into recycling programs in your area. Go here for more green resolution ideas.

Renovations: Whether you are doing the renovations yourself or working with a contractor, projects of scale are never easy. Make sure you plan for the inconvenience of going without a kitchen as well as the details of putting your new kitchen in place. Also, before investing in a renovation, make sure you will get a return on your investment when you resell. If you are looking to increase the value and marketability of your home check out this list before you start tearing down walls.

For more information on Windermere Evergreen and our team please contact us here.

Commercial Owner/ Investment Opportunity

Site approved for an Office Building with 9545 square feet of office space and

2115 square feet of common space. This commercial property represents a

unique owner/investment opportunity for a variety of business, professional or

service uses. Subject property is centrally located behind Staples Shopping

Center in Conifer with easy access to and from Highway 285. Highway 285 is

the primary route from the C-470 and the Greater Denver area to the mountain

areas serving residential, commuter and tourist traffic. Current land use along

Highway 285 serves as a commercial corridor for the surrounding communities

For more information, please visit the listings website.

You may also call Holly Roberts at (410)698-2617.

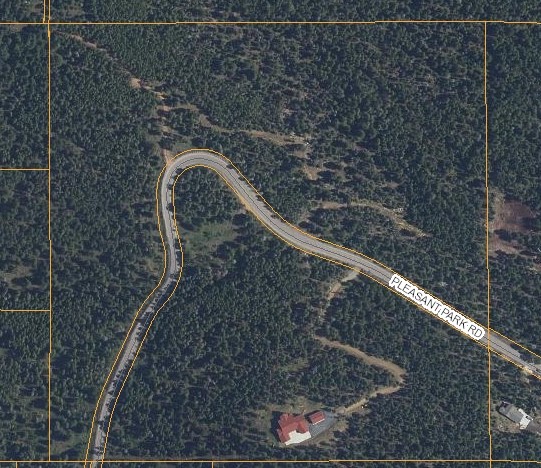

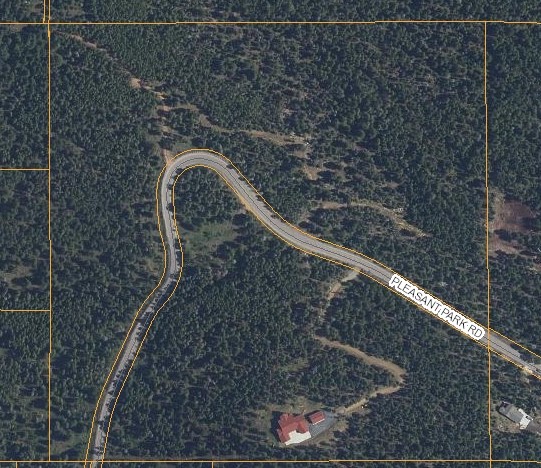

Conifer Proposed Town Home Project

Featuring 22.82 Acres

Centrally located in Conifer, Colorado on the main 285 corridor which is the

primary route to and from C-470, Denver and local communities. This

unique 22.82 acre project has been approved for 75 Town Homes and has

all approvals and infrastructure requirements in place including water and

sewer. Located just behind the busy Flagship Safeway Shopping Center

with all of its amenities. There is unparalleled NW Mountain views and this

property is located across 285 from top rated Colorado Elementary and

High-schools. Don’t miss out on this highly sought after 22.82 Acre

opportunity!

For more information please visit, the listing website.

You may also call Holly Roberts at (410)698-2617

The Tax Benefits Every Homeowner Should Know About

This article originally appeared in Times of San Diego

This article originally appeared in Times of San Diego

The housing market is predominantly very strong and more and more people are becoming homeowners. While there are many intangible benefits to owning a home, such as pride of ownership and setting down roots in the neighborhood, the tangible benefits are just as great. In addition to benefitting from possible appreciation, there are many tax deductions available that help reduce your annual income taxes.

Tax breaks are available for any type of home — single-family residence, town house, mobile home, or condominium. However, to take full tax advantage of owning a home, property owners need to understand the expenses they can deduct, and learn some tips to get the most tax advantages out of home ownership.

Mortgage Interest

A house payment is comprised of two parts: principal and interest. The principal goes toward reducing the amount you owe on your loan and is not deductible. However, the interest you pay is deductible as an itemized expense on your tax return. You can generally deduct interest on the first $1 million of your mortgage. You can also deduct interest on the first $100,000 of a home equity loan.

Property Taxes

Another big part of most monthly loan payments is taxes, which go into an escrow account for payment when the taxes are due. This amount should be included on the annual statement homeowners get from their lenders, along with their loan interest information. These taxes will be an annual deduction as long as the home is owned.

Home Improvements

If using a home equity loan or other loan secured by a home to finance home improvements, these loans will qualify for the same mortgage interest deductions as the main mortgage. Only the interest associated with the first $100,000 is deductible.Making improvements on a home can help you reduce your taxes in two possible ways:

- Tracking home improvements can help when the time comes to sell. If a home sells for more than it was purchased for, that extra money is considered taxable income. You are allowed to add capital improvements to the cost/tax basis of your home. If a home sells for more than it was purchased for plus any capital improvements, that extra money is considered taxable income. Keep in mind that most taxpayers are exempted from paying taxes on the first $250,000 (for single filers) and $500,000 (for joint filers) of gains.

Home Office Deduction

If a homeowner works from home, they can take a deduction for the room or space used as an office. This includes working from a garage, as well as a typical office space.

This deduction can include expenses like mortgage interest, insurance, utilities, and repairs, and is calculated based on “the percentage of your home devoted to your business activities,” according to the IRS.

Home Energy Tax Credits

For homeowners looking to make their home a little greener, the Residential Energy Efficient Property Credit can help offset the cost of energy efficiency improvements. People who install solar panels most commonly take advantage of this credit. Homeowners can save up to 30 percent of the total cost of installing certain renewable energy sources in their home. Even better, this is a credit, which means it directly lowers a homeowner’s tax bill.

Of course, every homeowner’s financial situation is different, so please consult with a tax professional regarding your individual tax liability.

For more information on Windermere Evergreen and our team, please contact us here.

DIY: Giving Our Fireplace a Facelift

A story of a DIY project… While we were willing to do some major updates to the bathroom, plumbing and electrical, we decided to pick a few areas of our 1940s fixer to do some smaller, mostly cosmetic updates. One of these projects included giving the fireplace a little facelift to bring it into this century.

When the house was built, we believe the fireplace was a simple plaster build-out. At some point, the original owners of the home laid on these tan tiles in a decorative pattern around the fireplace. They may have added the wooden mantel piece, as well. And in the 70s, perhaps they added the black and bronze fireplace cover. Not completely sure as this home was an estate sale (which means the owner either passed away or moved into an assisted living community — and in this case, we know the owner passed away in her 90s in another home).

We were told that there is gas available on the street so at some point, we’ve love to add a gas insert for a gas fireplace and stove. Rumor has it, Seattle may outlaw burning real wood in fireplaces within the next couple of years. But that gas fireplace update will take more time, money and permits. So for now, we paint.

After the contractors left, we noticed some brown/yellow stains on the plaster facing. My wife, our resident painter, tried to paint over the stains. Even after two or three coats, the marks were still pretty apparent. We waited until we could have our young daughter, out of the house before trying to prime the fireplace with industrial strength primer. The guy at the hardware store even suggested buying a “throw-away” paintbrush for a few bucks because to get this primer off of a normal brush would take more industrial strength cleaner. Two coats of that primer stuff and voila! Stains hidden.

After the primer dried, she painted the tiles (sorry previous owners!) and fireplace face a bright white which instantly modernized the whole room. We contemplated painting the black half circle that’s part of the fireplace cover but decided against it, mostly because we had already put our paint supplies away and #tired.

The fireplace has some areas that need some grout repair and one of the tiles is cracked (and has been for God-knows how long) but this was a nice, easy win. When you’re doing home renovations, not much feels easy so three cheers for a white fireplace that only required three trips to the hardware store.

For more information on Windermere Evergreen and our team, please contact us here.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link