The Remote Worker’s Home Buying Process

Image Source: Getty Images

The pandemic’s influences on home life are far-ranging, prompting buyers to look at homeownership through a new lens. Remote work has created a paradigm shift in the wants and needs of homebuyers. Here’s what the remote worker should keep in mind when looking to buy.

Location

The location, location, location cliché has taken on new meaning for homebuyers who work from home. Because remote work gives us the opportunity to work from anywhere, home searches are expanding. Work commute times typically play a significant role in the home buying process; however, many buyers now have the option to view homes further away from their places of work.

Those who previously dreamed of the quiet life, but didn’t want the commute that came with it, are now able to make a move toward a more suburban environment. If you prefer to be away from the hustle and bustle of a downtown area but don’t want to feel isolated, search for properties in the suburbs with active town centers.

The proper space

When COVID-19 began sending workers home in the early months of 2020, homeowners worldwide discovered their varied level of preparedness for remote work. Some had spacious home offices and were able to make the transition easily. Others had to create makeshift workspaces out of living rooms or bedrooms. What we have learned is that a dedicated workspace is paramount to productive remote work, its importance emphasized by the unknown timeline of a return to working in-person in many parts of the country.

- When searching for homes, understand that a home office situated in an open floor plan is more prone to distraction.

- Look for features such as an additional bedroom, finished basement, or bonus room that offer ample space to create your remote work environment.

- Having a designated space you can associate solely with work will not only drive your focus but helps to balance your home and work life. It allows you to wrap up the workday, leave your home office, and easily transition back into the goings-on of your household.

- Light it up: You’ll want plenty of light in your home office to stay fresh throughout the workweek. If you are next to a window, let in as much natural light as possible. Add in desk and floor lamps to brighten your space.

- Work comfortably: While working at home, it’s easy to sit in one place for hours on end. Shop for comfortable desk chairs that provide proper lumbar support. Explore alternatives to desk chairs like yoga balls and standing desks.

- Personalize: Adding personal touches will help to make your home office feel comfortable. Inspirational quotes, your favorite artwork, and pictures of loved ones are all types of décor that will keep you inspired in your remote work.

For all these considerations and more, talk with your Windermere agent about how your remote work is shifting where you’re looking for a home and what you’re looking for when it’s time to move there.

Why Not White Marble?

Are you thinking about replacing your kitchen or bathroom countertops? The choices are endless; tile, granite, soapstone, wood, or maybe marble? White marble often gets a bad rap because it’s a more porous metamorphic stone than most (which means it’s prone to stains and scratches), but we beg to differ, and here’s why.

White marble is as timeless as it is modern. Adding white marble to your kitchen or bathrooms is like bringing home flowers for your significant other; always a good idea. It looks great on kitchen counters, but also just about anywhere in your bathrooms, from the floor to the shower walls. Adding white marble countertops to a dressing vanity in bedrooms is also a great way to incorporate it throughout your house.

After you’ve made the decision to install white marble into your home, you’ll need to decide on a finish. Honing gives a matte finish, whereas polishing creates a shiny, reflective surface. If you want to reduce etching, choose a honed finish instead of a polish. If you don’t mind some added etching, then polished white marble is as stunning as it sounds.

How do you keep your marble happy? Make sure to apply a seal prior to using it. To reduce staining, wipe away spills immediately, and only use a neutral detergent to clean your marble. These simple things will keep your white marble in shipshape condition.

When it comes to your marble, it’s more like you than you think. Marble goes through good times and bad times and some scars fade better than others. It will never be perfect, but in the end, we think you’ll love it—imperfections and all.

Check out white marble looks we love on Pinterest.

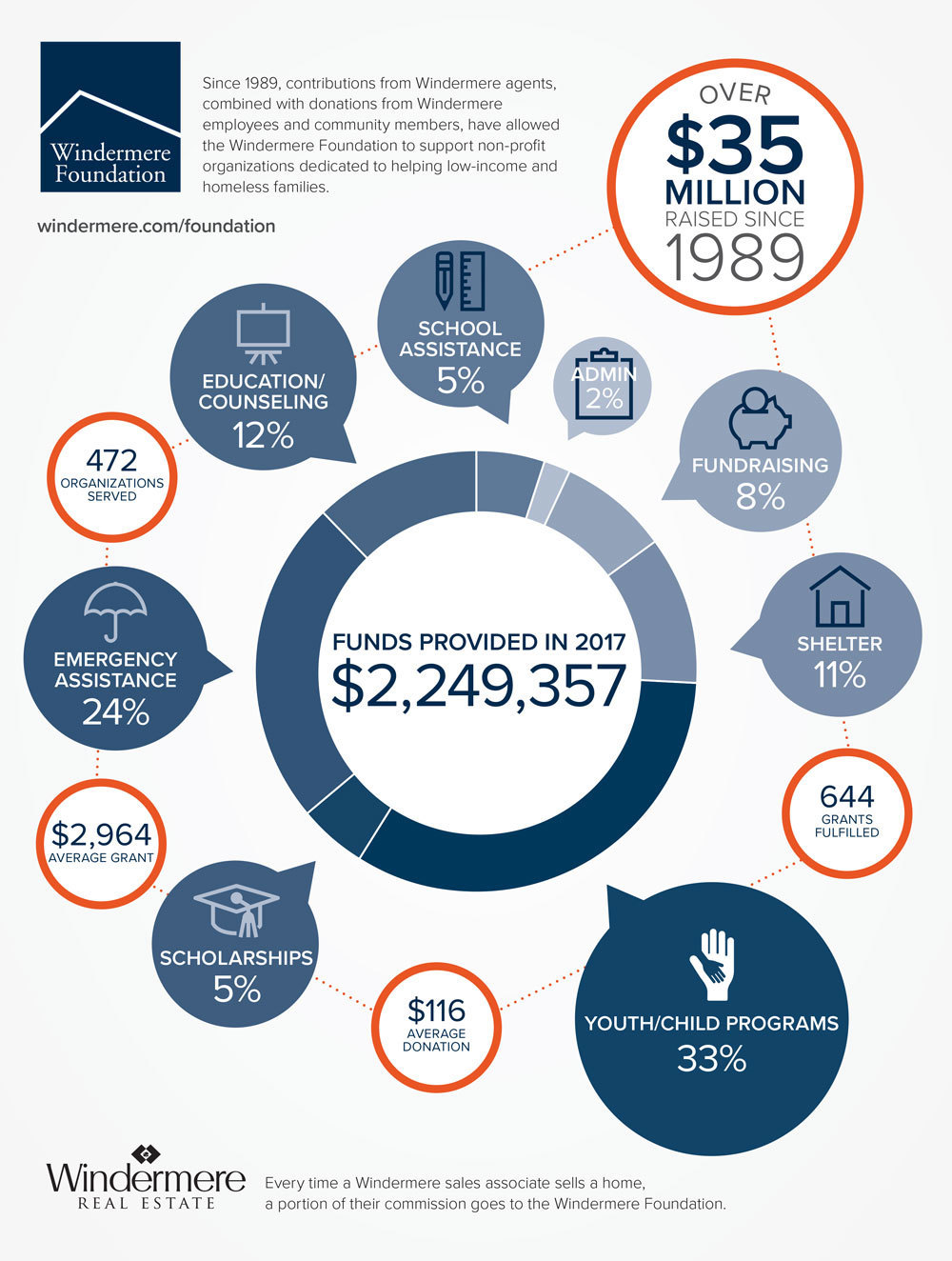

Windermere Foundation by the Numbers

For the past 29 years, the Windermere Foundation has been helping those in need in our communities through donations to local organizations that provide services to low-income and homeless families. In 2017, the Windermere Foundation raised over $2.4 million in donations, bringing the total to over $35 million raised since we started this effort in 1989. The following infographic details exactly how these funds were dispersed in 2017 and the types of organizations that benefited from them. For more information please visit windermere.com/foundation.

Selling your home: A step-by-step approach

Whether you’re starting a family, moving for your job, getting ready to retire or embarking on a new chapter in your life, when your home no longer suits your current situation, it’s time to think about selling it. Although this can be a bit complicated, with the help of your agent, you can minimize the hassles, get the best possible price, and shorten the distance between “For Sale” and “Sold”.

Price it right

If you want to get the best possible price for your home and minimize the time it stays on market, you need to price it correctly from the beginning. Your agent can give you a clear picture of your particular market and can provide you with a comparative market analysis (CMA). A CMA contains detailed information on comparable homes in your area, including square footage, date built, number of bedrooms, lot size and more. It lists pending sales and houses sold in your area in the past six months, along with their actual sale prices.

By comparing your home to similar homes in your neighborhood and reviewing their list prices and actual selling prices, your agent can help you arrive at a fact-based assessment of your home’s market price.

Prepping your house for sale

You want to make a positive first impression when you list your home for sale. Here are some tips on how to enhance your home’s best features:

Work on your curb appeal

Get rid of moss on your roof. Power wash your front walk, porch, deck and patio. Mow the lawn, trim the hedges, weed the flowerbeds and add spots of color with container plants. Clean all the windows inside and out and repair them if they don’t open and close easily.

Refresh, repair and repaint

This goes for interiors and exteriors. If you see peeling paint, add a fresh coat. If your living room is bright lime green, consider painting it a more neutral shade. Make necessary repairs. You don’t want to turn off a buyer with a dripping faucet, a broken doorbell, a clogged downspout or a cracked windowpane.

Deep-clean, from floor to ceiling

Clean rugs, drapes and blinds and steam-clean carpeting. Get rid of any stains or odors. Make sure kitchen appliances, cupboards and counters are spotless and that bathrooms shine.

Declutter and depersonalize

Clean, light-filled, expansive rooms sell houses. So be sure to downsize clutter everywhere in your home, including cupboards, closets and counters. You might also consider storing some furniture or personal items to make rooms look more spacious. Take advantage of views and natural light by keeping drapes and blinds open.

Make an impact on the market

If you want to sell your home, you need to go where the buyers are, and today they’re on the Internet. According to the National Association of REALTORS®, in 2012 90 percent of homebuyers used the Internet as an information source, and for 41 percent of homebuyers it was the first step in the home-buying process.

By working with your agent, you can list your home on Windermere.com and other relevant websites. He or she will put together a listing with attractive photos, an appealing description and all the information a potential buyer needs. Your agent will also market your house, which may include advertising, direct mail and open houses.

Show your house

After you’ve taken care of all the repairs and cleaning tasks outlined above, your home is ready for its close-up: an open house. It’s actually best for you and your family to leave when potential buyers are present so they can ask your agent questions. But before you go, you might want to:

· Take your pets with you

· Open the shades and turn on the lights

· Light a fire in the gas fireplace

· Bake cookies

· Keep money, valuables and prescription drugs out of sight

Be flexible in negotiating

If you get offers below your asking price, there are a number of strategies you can try in your counteroffer. You could ask for full price and throw in major appliances that were not originally included in the asking price, offer to pay some of the buyer’s fees, or pay for the inspection. You could also counter with a lower price and not include the appliances. If you receive multiple offers, you can simply make a full-price counter.

Your agent can suggest other strategies as well and help you negotiate the final price.

If your house doesn’t sell or you’ve received only lowball offers, ask your agent to find out what these prospective buyers are saying about your house. It might reveal something you can consider changing to make your house more appealing in the future.

Breeze through your inspection

When a buyer makes an offer on your home, it’s usually contingent on a professional inspection. A standard inspection includes heating and cooling, interior plumbing and electrical systems; the roof, attic and visible insulation; walls, ceilings, floors, windows and doors; and the foundation, basement and visible structure. The inspector will be looking for cracks in cement walls, water stains and wood rot.

You can always opt for having an inspection done prior to putting your house on the market, so you can address any potential problems in advance. Your agent can give you several recommendations for qualified inspectors in your area.

Close with confidence

Whether this is your first time or your tenth, your agent can help guide you though the complex process of selling a home. Moreover, he or she can answer any questions you may have about legal documents, settlement costs and the status of your sale.

Your agent’s expertise, resources and extensive network also work for you when you’re buying your next house. Even if you’re moving out of the area, your agent can refer you to a professional agent in your new community.

For more information on Windermere Evergreen and our agents, please contact us here.

Take it outside!

Dust off your grill and get ready, it is the kick-off to barbecue season! Hopefully your summer is on its way to a good start and the weather is cooperating. The 4th of July always feels like the official start to the summer for me (perhaps because Seattle doesn’t usually get too sunny and warm until after the holiday). Now that the sun is shining and the air is warm it is time to spend more time outside.

Dust off your grill and get ready, it is the kick-off to barbecue season! Hopefully your summer is on its way to a good start and the weather is cooperating. The 4th of July always feels like the official start to the summer for me (perhaps because Seattle doesn’t usually get too sunny and warm until after the holiday). Now that the sun is shining and the air is warm it is time to spend more time outside.

Extending your living space to the outdoors is nice for relaxing and entertaining. Here are some quick ideas to make your backyard patio more comfortable all summer long.

Grounds

Take a look at your surroundings and make some little changes that will make your outdoor time more enjoyable. Some easy updates for your backyard can be functional, like setting your sprinkler on a timer, so technology can water your yard and you can spend more time relaxing. Or find aesthetically pleasing replacements for necessary items like your hose storage. Other improvement can help transform your space into a sanctuary, like planting flowers to attract hummingbirds and butterflies.

Furniture

The best outdoor furniture looks nice, feels comfortable, withstands the elements and is easy to store once the weather turns. You should consider how you plan to use your space: for lounging and reading a book, playing with the kids, entertaining, or all of the above. Treat outdoor spaces as an extension of your living room or dining room. Pick items that reflect your taste and serve your needs. If you grill a lot, extend your kitchen prep outside with tools and a surface ready at a moment’s notice. Or find a neat bar cart to have drinks accessible for your parties.

Lighting

Make sure you can enjoy your space after the sun goes down with the right lighting solutions. Candles are nice, but they can be a hazard if someone knocks them over or you forget them after you go indoors. Consider the mood you want to set and what you need to adequately light pathways and stairs. There are many options ranging from homemade to high-end and solarto electric.

Entertaining

Keep your entertaining supplies ready for impromptu gatherings with outdoor furniture that doubles as storage space. That way you don’t have to go searching for plastic table wear every time. Same goes with outdoor toys and games; use a closed plastic bin to store croquette sets, inflatable pool mats, and other fun gear. Another fun idea is setting up your own outdoor theater for late night showings and double features.

These are just a few of the ideas I’ve considered for upgrading an outdoor living space. How do you make the most of your outdoor space during the summer?

For more information on Windermere Evergreen, please contact us here.

A little goes a long way: a top ten list for making the most of your home improvement

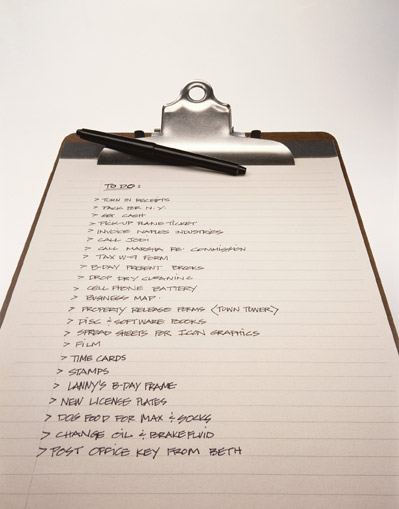

This weekend I spent the greater part of Saturday taking care of the ongoing household to do list and the transformation made a huge impact. There certainly is more to do, as is the nature of home improvement, but having a finite list of things to accomplish and making time to enjoy them made all the hard work worth it! Here is my top ten list of how to make the most of your time when tackling home-improvement projects.

This weekend I spent the greater part of Saturday taking care of the ongoing household to do list and the transformation made a huge impact. There certainly is more to do, as is the nature of home improvement, but having a finite list of things to accomplish and making time to enjoy them made all the hard work worth it! Here is my top ten list of how to make the most of your time when tackling home-improvement projects.

1. Imagine your perfect place. Your home should reflect your personality, the way you spend your time, and fit your needs. If you want a place to entertain, to relax and meditate, to create art, nurture your children, or display your collections, you will want to consider your priorities. Once you have explored the possibilities the next step is to prioritize your to-do list in order to make the most impact.

2. Make a list. Some home project lists could go on and on (and on), so it’s a good idea to write out a list and discuss the details with the members of your household so you know where to start and who is responsible for what.

3. Prioritize. Once you know what needs to be done it’s time to prioritize the list. If there is something timely (like getting gutters before the fall) keep that in mind when prioritizing, but also think about those projects that will bring you the most joy in daily life.

4. Do one project that really makes a difference. I recently finished sprucing up the living and dining rooms with new curtains and new furniture for storage and display. These are the rooms I spend the most time in at home, so the difference is palpable to how I view my home. Now we are ready for a big dinner party which is one of the most important things in our household. From this experience, I realized that small changes and some cleanup can make a huge difference.

5. Keep it reasonable. Make sure your list is reasonable. The goal isn’t to get everything done in one weekend, which typically isn’t feasible anyway. Rather, you want the time you invest in your home to be enjoyable and give you the sense of satisfaction (and motivation to do more).

6. Gather your tools. Nothing will derail a project like not having the right tools. Once you know what you are going to accomplish make sure all your supplies are ready. You’ll be far more efficient if you hit the hardware store, fabric store, gas station, etc. prior to getting started.

7. Work together. Some projects are two-people projects. If you share your household, enlist other members to share the work. Some projects need two people to lift, spot, hand tools, push, pull, etc. If you live alone, have a work party by inviting a friend over to help. You can return the favor if they ever need help with a household project.

8. Enjoy the process. Blast music, take breaks, and step back to reflect on your household improvement. If you need to dedicate a weekend to doing your chores, you may as well still enjoy it!

9. Get the list done. If you’ve taken the time to make your list reasonable you shouldn’t have any trouble completing it. Doing so will reaffirm your sense of accomplishment, so when you look at what was done, you won’t be thinking about what you have to do next.

10. Bask in your success. Focus on the improvement, enjoy your space, and most importantly, use it! If you made your bedroom a sanctuary, light a candle and relax with a good book. If you reconfigured your kitchen for more efficient use, have your own Iron Chef moment and cook a huge meal. Just remember, all your planning and hard work should be enjoyed.

What are your tips for making the most out of your home?

For more information on Windermere Evergreen, please contact us here.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link