Find a New Home in Four Steps

Whether you’re a first-time homebuyer or a current owner looking for a bigger home, the ideas below will help you better navigate that all-important first step: Finding a property that you like (and can afford).

The search for a new home always starts out with a lot of excitement. But if you haven’t prepared, frustration can soon set in, especially in a competitive real estate market. The biggest mistake is jumping into a search unfocused, just hoping to “see what’s available.” Instead, we recommend you first take some time to work through the four steps below

Step 1: Talk to your agent

Even if you’re just thinking about buying or selling a house, start by consulting your real estate agent. An agent can give you an up-to-the-minute summary of the current real estate market, as well as mortgage industry trends. They can also put you in touch with all the best resources and educate you about next steps, plus much more. If you are interested in finding an experienced agent in your in your area, we can connect you here.

Step 2: Decide how much home you can afford

It may sound like a drag to start your home search with a boring financial review, but when all is said and done, you’ll be glad you did. With so few homes on the market now in many areas, and so many people competing to buy what is available, it’s far more efficient to focus your search on only the properties you can afford. A meeting or two with a reputable mortgage agent should tell you everything you need to know.

Step 3: Envision your future

Typically, it takes at least five years for a home purchase to start paying off financially, which means, the better your new home suits you, the longer you’ll most likely remain living there.

Will you be having children in the next five or six years? Where do you see your career heading? Are you interested in working from home, or making extra money by renting a portion of your home to others? Do you anticipate a relative coming to live with you? Share this information with your real estate agent, who can then help you evaluate school districts, work commutes, rental opportunities, and more as you search for homes together.

Step 4: Document your ideal home

When it comes to this step, be realistic. It’s easy to get carried away dreaming about all the home features you want. Try listing everything on a piece of paper, then choose the five “must-haves,” and the five “really-wants.”

For more tips, as well as advice geared specifically to your situation, connect with an experienced Windermere Real Estate agent by clicking here.

13 Appliance Tips & Hacks for Household Chores

Modern home appliances make our lives so much easier: They tackle dreaded household chores, saving us time and effort. There are lots of ways to use them, however, that you may not have thought of before. From cleaning your ceiling fixtures in the dishwasher to vacuuming your pet, here are 13 little-known tricks for getting more than your money’s worth from your appliances.

- Sanitize small toys and more. Use your dishwasher to wash and sanitize teething rings, small plastic toys, mouth guards, and even baseball caps. Place items on the top rack and run the dishwasher as usual with detergent (without any dirty dishes). Put smaller items in a small mesh laundry bag so that they don’t move around.

- Clean ceiling fixtures. At least once or twice a year, remove and clean your glass ceiling fixtures and light covers in an empty dishwasher. Run the machine on the normal cycle.

- Eliminate wrinkles from clothing. To smooth out wrinkled clothes or linens left too long in the dryer, toss a damp, lint-free cloth in with them. Run the load on the lowest setting for 10 to 15 minutes. Newer dryers also feature a steam setting that removes wrinkles and refreshes clothing between wears.

- Disinfect sponges and dishcloths. Kitchen sponges and dishcloths contain billions of germs. Clean and disinfect them daily by zapping them on high in the microwave for 2 minutes to kill germs.

- Freshen up your curtains. Vacuum heavy drapes with the upholstery attachment. Use the dusting brush attachment for lighter drapes. Wash sheer curtains in the washing machine on the delicate cycle, then hang them up while they’re damp to prevent wrinkles.

- Remove wax from fabric or carpet. To get rid of wax on a tablecloth, place it in your freezer until the wax is hard. Then put a flat paper bag over the wax and another under the fabric. Iron the top bag with a medium-hot iron until all the wax transfers to the bag. To remove wax from a carpet or rug, place an ice pack on the spot until the wax hardens. Shatter the wax and vacuum up the chips.

- Clean baseboards. Dusting baseboards can be a backbreaking chore. Use your vacuum cleaner and the dusting brush attachment to avoid having to bend down. Do the same to clean chair and table legs.

- Organize your fridge. Use the built-in features of your refrigerator to organize food by category. Designate certain shelves or areas for leftovers, preferably front and center, so you don’t forget they’re in there. Use special-purpose bins for their intended use: crispers for vegetables, deli trays for deli meats and cheeses, cold storage trays for meats. Newer models also feature convertible cooling zones to keep food fresh.

- Dust blinds. Extend the blinds fully and turn the slats to the closed position. Use the dusting brush attachment on your vacuum cleaner to clean the slats from top to bottom. Then open and reclose the slats in the opposite direction and repeat the process.

- Clean your microwave. The best time to clean your microwave is immediately after using it. Thanks to residual steam, all you have to do is wipe it out with a paper towel or damp sponge. To clean old messes, microwave 2 cups of water on high for 5 minutes. The steam will soften cooked-on spills, which you can wipe off with a paper towel or cloth.

- Exterminate dust mites. Dust mites live off human and animal dander and other household dust particles. They thrive in sofas, carpets, and bedding. Use the upholstery attachment to vacuum your mattress and upholstered furniture regularly to minimize dust mites. Be sure to empty the canister in an outdoor trashcan.

- Groom your pet. If your dog or cat doesn’t hide when you get out your vacuum cleaner, try using the dusting brush attachment to brush your pet. It’s a gentle way to collect shedding fur.

- Remove grime from shower liners. Wash plastic shower curtain liners in the washing machine with hot water and detergent on the regular cycle. Throw in a small bath towel to help “scrub” mildew and soap scum off the liner. Then rehang the liner and let it air-dry.

Have you found any unusual cleaning hacks for your appliances? Share in the comments below!

Organizing and cleaning expert Donna Smallin Kuper writes for The Home Depot about easy organization hacks, including the best ways to use your appliances. To view The Home Depot’s selection of appliances, click here.

For more information please contact us here.

This article is editorial content that has been contributed to our site at our request and is published for the benefit of our readers. We have not been compensated for its placement.

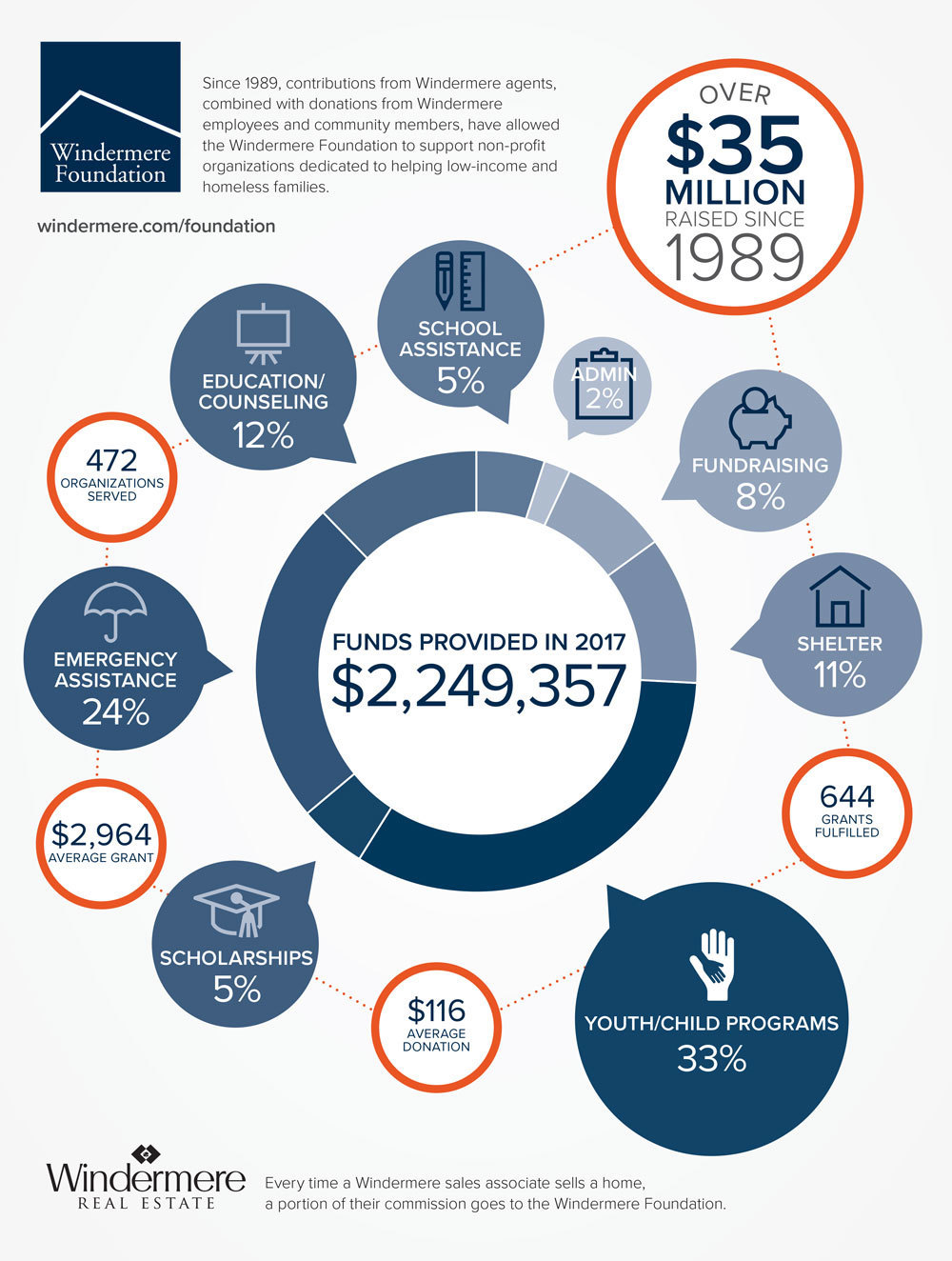

Windermere Foundation by the Numbers

For the past 29 years, the Windermere Foundation has been helping those in need in our communities through donations to local organizations that provide services to low-income and homeless families. In 2017, the Windermere Foundation raised over $2.4 million in donations, bringing the total to over $35 million raised since we started this effort in 1989. The following infographic details exactly how these funds were dispersed in 2017 and the types of organizations that benefited from them. For more information please visit windermere.com/foundation.

How Tax Reform Affects Homeowners

New tax legislation was signed into law at the end of 2017, and it included some significant changes for homeowners. These changes took effect in 2018 and do not influence your 2017 taxes. Here’s a brief overview of this year’s tax changes and how they may affect you*.

The amount of mortgage interest you can deduct has decreased.

Under the old law, taxpayers could deduct the interest they paid on a mortgage of up to $1 million. The new law reduces the mortgage interest deduction from $1 million to $750,000. These changes do not affect mortgages taken out before December 15, 2017.

The home equity loan deduction has changed.

The IRS states that, despite newly-enacted restrictions on home mortgages, taxpayers can often still deduct interest on a home equity loan, home equity line of credit (HELOC) or second mortgage, regardless of how the loan is labeled. The Tax Cuts and Jobs Act of 2017, enacted December 22, suspends from 2018 until 2026 the deduction for interest paid on home equity loans and lines of credit, unless they are used to buy, build or substantially improve the taxpayer’s home that secures the loan.

The property tax deduction is capped at $10,000.

Previously taxpayers could deduct all the state, local and foreign real estate taxes they paid with no cap on the amount. The new law limits the deduction for all state and local taxes – including income, sales, real estate, and personal property taxes – to $10,000.

The casualty loss deduction has been repealed.

Homeowners previously could deduct unreimbursed casualty, disaster and theft losses on their property. That deduction has been repealed, with an exception for losses on property located in a federally declared disaster area.

The capital gains exclusion remains unchanged.

Homeowners can continue to exclude up to $500,000 for joint filers or $250,000 for single filers for capital gains when selling their primary residence as long as they have lived in the home for two of the past five years. An earlier proposal would have increased that requirement to five out of the last eight years and phase out the exclusion for high-income households, but it was struck down. Find out more about 2018 tax reform.

How does tax reform affect your plans for buying or selling a home?

The changes in real estate related taxes may change your strategy. Contact your Windermere agent to learn more. If you need help finding an agent, we’re happy to help.

*Please consult your tax advisor if you have any questions about how the new tax reform impacts you

For more information on Winderemere Evergreen, please contact us here.

Make the Most of the Home You Have

If you have been in your home for a while you may be restless for change. The great part about having a home of your own is you can make improvements and give your home a chance to evolve over time. You just need to help your home live up to its potential! Here is a top ten list of improvements that will help you make the most of your home.

Find your home’s purpose. Each home is as unique as its owners, so in order to fully utilize your home, consider how you view your home’s purpose. Some people like to entertain, others find it a calm space in the frenzy of daily life; some nurture their families and others nurture their creativity. Your home’s purpose can be any combination of these and more, but it helps to consider the function of your space in order to ultimately find its purpose.

Assemble a list. A list always helps me figure out where to start or prioritize what is the most important project. Think about what you want to change in your home, inspirations, and preferences. .

Make an “inspiration board”. An “inspiration board” is a great way to visualize your home’s decor. You can create a board online with a tool like Pinterest to organize ideas you love or you can do it the old fashioned way with a board, magazine cutouts, color swatches, and fabric samples. Doing this will allow you to see all the elements you like in one place so that you can then tie it all together into a room you love.

Create a collection. If you have items that you like to collect, think about how to transform that collection into something you can display. If you don’t already have a collection of loved objects think about what this collection would be for you. You can center a room design around your travel souvenirs, old camera collection, figurines, unique plates, or familial objects. Adding to this collection over time can be a great way to keep your spaces new while maintaining a personal feel to your decor.

Choose a new palate. Shake up your sensibilities and think of a color that will compliment your room while making a statement. It’s easy to fall into the white/beige standby to keep our rooms neutral, but sometimes a color that provides a contrast to your décor will make the room pop.

Repurpose an old piece of furniture. Instead of replacing your furniture give it a facelift. You can have a sofa or chairs reupholstered or make use of a slip cover. Also, Painting and staining can add new life to your wood pieces.

Rearrange. Moving furniture around is another easy way to reinvent your space. Try placing your sofa on an angle to open up your entertaining room or move your lamps to improve lighting. You can also think about moving a piece of furniture into a room to give it new life, like using a unique dresser for a credenza or a chair as a side table.

Make a room of your own. Find some space in your home that is uniquely yours, whether this is the corner of the guest room or an office of your own. It can be very rewarding to have a space that you can organize to fit your personal needs without the worries of others intruding

Find an inspirational object. Have you ever fallen in love with an object that inspired you to want to completely redo a room to accommodate it? Designing a room around an inspiring object can be a great way to create a space that truly embodies your design sensibility.

Find design motivation. Home design evolves over time and can be sustained by finding items that inspire you. Read magazines and books that inspire your interests in architecture, design, art, etc. Or find stores and flea markets that sell pieces that influence your aesthetic. Or bring a camera with you when you’re doing your favorite activities and bring back memories or inspirations. Most of all have fun!

What inspires your home design?

For more information on Windermere Evergreen and our agents, please contact us here.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link