Q3 2021 Colorado Real Estate Market Update

The following analysis of the Metro Denver & Northern Colorado real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

The rise in COVID-19 infections due to the Delta variant caused Colorado’s job recovery to slow, but not as much as in many other states. The latest data (for August) shows that more than 293,000 of the 376,000+ jobs that were shed due to COVID-19 have returned. This is good news, with only 83,000 jobs needed to return to pre-pandemic employment levels. The metro areas contained in this report have recovered 243,700 of the 310,000 jobs lost, and I expect the state will recover the remaining jobs by next summer. With employment levels improving, the state unemployment rate currently stands at 5.9%—down from the pandemic peak of 12.1%. Regionally, unemployment levels range from a low of 4.4% in Boulder to a high of 6.1% in Grand Junction.

__________

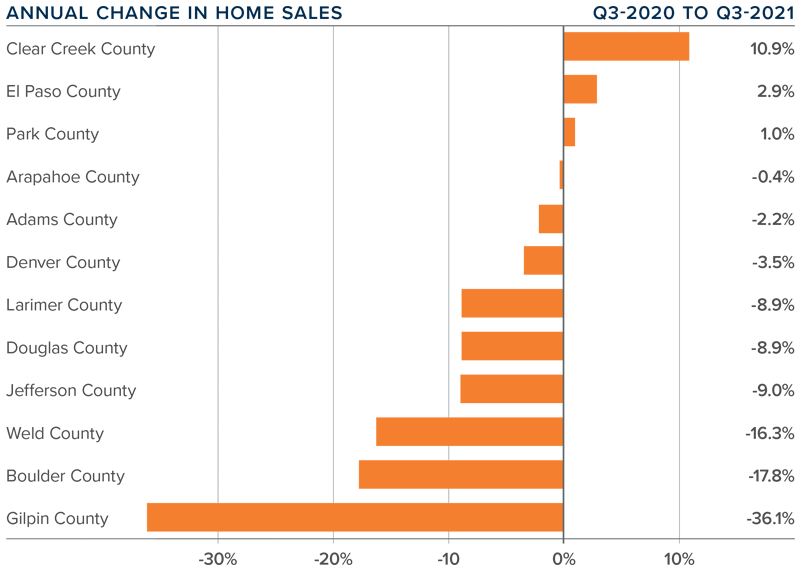

Colorado Home Sales

❱ Compared to a year ago, listing activity was down more than 30%. However, inventory levels were up 38.3% compared to the second quarter of this year, suggesting that buyers have more choice now than they have seen in some time.

❱ Although comparing current sales activity with that of a year ago is not that informative—given that the country was experiencing a massive rebound in housing demand following the outbreak of COVID-19—it was pleasing to see sales up in every county other than Denver and Douglas compared to the second quarter of this year.

❱ Pending sales (an indicator of future closings) were down 5.4% compared to the second quarter of the year, suggesting that closings in the final quarter may well be a little soft.

__________

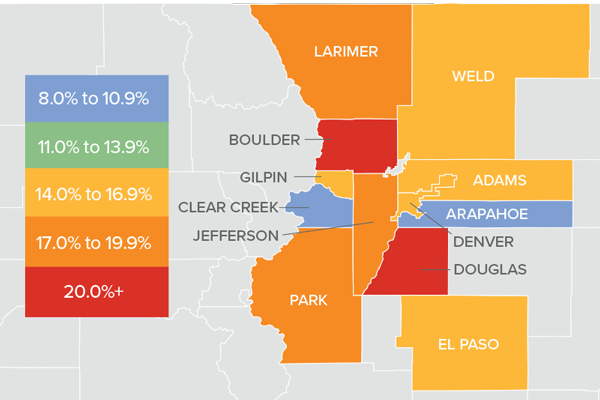

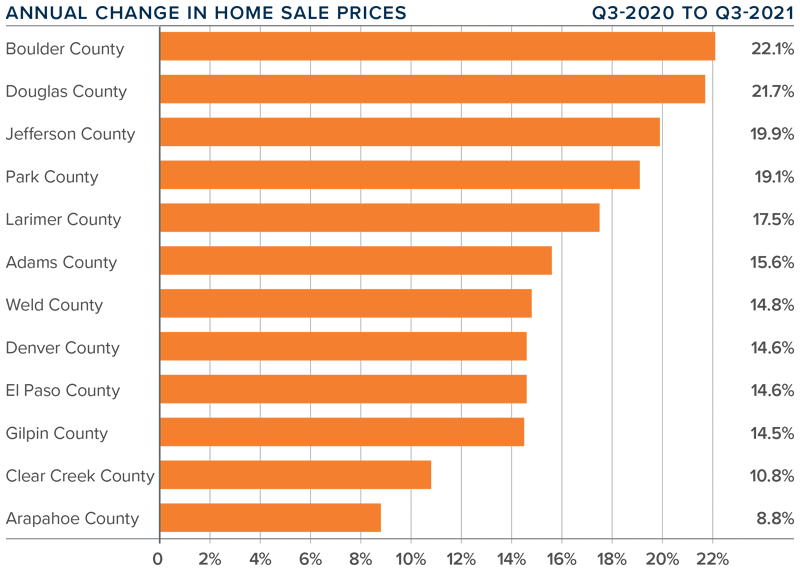

Colorado Home Prices

❱ Prices continue to appreciate at a very rapid pace, with the average sale price up 15.8% year over year to an average of $605,576. Sale prices were 1.6% lower than in the second quarter of 2021.

❱ Four counties—Arapahoe, Douglas, Weld, and Park—saw the average home sale price pull back between the second quarter and the third, but I am not overly concerned by this at the present time.

❱ Year-over-year, prices rose across all markets covered by this report. All counties except Arapahoe saw double-digit gains, but even that market saw an increase in sale prices.

❱ Several counties are experiencing a drop in average list prices, which is a leading indicator of future activity. As such, I expect to see the rise of sale prices start to slow, which will be a welcome sight for many buyers.

__________

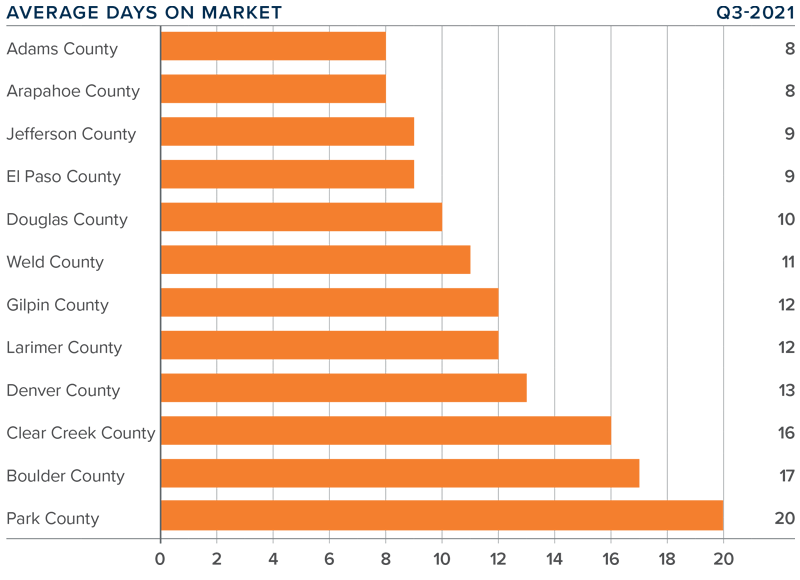

Days on Market

❱ The average number of days it took to sell a home in the markets contained in this report dropped 17 days compared to the third quarter of 2020.

❱ The length of time it took to sell a home dropped in every county contained in this report compared to both the same quarter a year ago and the second quarter of this year.

❱ It took an average of only 12 days to sell a home in the region, which is down 2 days compared to the second quarter of 2021.

❱ The Colorado housing market remains very tight as demonstrated by the fact that it took less than three weeks for homes to sell in all counties contained in this report.

Conclusions

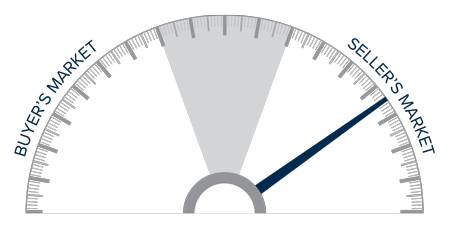

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The job market continues to improve, which is always a stimulant when it comes to home buying. Inventory levels have improved, and lower pending sales suggest that buyers are taking a little longer to decide on a home. That said, the market is still bullish as indicated by the short length of time it took to sell a home in the quarter. Mortgage rates will start to creep higher as we move into the winter months, and this may stimulate additional buying activity. In the last edition of The Gardner Report, I suggested we would see more homes come to market and that has proven to be accurate. Given these factors, I am moving the needle a little toward buyers, but it remains a staunchly seller’s market.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

2 to 3

Along the Front Range we have gone from two weeks of inventory to three weeks.

For much of the Spring, there was only two weeks of inventory on the market in most areas. Meaning, it would only take 14 days to sell all of the homes currently for sale.

Now, because the pace of sales has slightly slowed down and there is a bit more inventory, there is roughly three weeks.

We can actually measure inventory in number of days based on the pace of sales in July so far:

- Metro Denver = 23 Days

- Larimer County = 22 Days

- Weld County = 22 Days

This is obviously good news for buyers as they have better selection and slightly less competition.

6 Foyers That Invite in Style

Entryway 1: Jackson and LeRoy, original photo on Houzz

With a side entrance to your home, you can be a little more forgiving when it comes to messes. But with a front-door entry, through which you and your guests get a first impression of your home, you’ve got to be a little more on top of your style and storage game. The following are some of the most popular front-entry photos recently, as measured by the number of people who saved them to their Houzz ideabooks from January through March. Let us know which will inspire your next project

A classic wooden bench offers a spot to take off and put on shoes in this farmhouse-style entryway in Utah.

Related: Wipe Your Shoes on a Durable Outdoor Rug

Entryway 2: Nicole Benveniste Interior Design, original photo on Houzz

Benjamin Moore’s Plaster of Paris paint on the walls sets the soothing tone for this spacious San Francisco entry. A large painting featuring pale swaths of color hangs over a few well-chosen accessories atop a weathered wood table, starting this home off on the right foot.

Entryway 3: Brian Paquette Interiors, original photo on Houzz

Here, a burl-wood-type table and vibrant abstract art create movement and excitement.

Related: Flower Vases for the Entryway

Entryway 4: Tim Barber Ltd Architecture, original photo on Houzz

A rich wood built-in helps organize this Los Angeles entry. A frosted, ribbed glass window obscures the view into the living room.

Entryway 5: NEST Interior Design Group, original photo on Houzz

An eclectic mix of art and accessories beckons guests into this Houston home. A table offers a spot for keys and wallets, while wire baskets below can handle shoes and bags.

Entryway 6: Fluidesign Studio, original photo on Houzz

Creamy shiplap walls, rich wood floors and a wood console table establish a refreshing air in this Minneapolis home.

By Mitchell Parker, Houzz

Fruit Trees for a Small Garden

I have a very small backyard, but I still dream of planting a garden with a few fruits and vegetables like tomatoes, kale or strawberries. I never thought I had enough space for a fruit tree until I recently discovered dwarf fruit trees. Even if you have a large garden area, dwarf fruit trees are a great option as they take much less space.

Dwarf fruit trees:

Come in many types – apples, cherries, lemons, oranges, pears and more

-

- Grow anywhere from 3 to 15 feet tall

-

- Can grow in an 8″ diameter pot or in the ground

-

- Yield full size fruit

-

- Require 8-10 hours of full sun

-

- Usually the variety of fruit is grafted to a type of rootstock that keeps the tree shorter (a rootstock is a type of root that is specifically grown for other plants to be attached to)

Where can you find one?

Your local nursery is the best place to find a dwarf fruit tree.

Glean extra fruit for your local food bank

If you end up with more fruit than you can eat, be sure to find a gleaning organization in your area. These groups can collect the extra fruit throughout a neighborhood and donate the harvest to a local food bank.

For more information on Windermere Evergreen, please contact us here.

A little goes a long way: a top ten list for making the most of your home improvement

This weekend I spent the greater part of Saturday taking care of the ongoing household to do list and the transformation made a huge impact. There certainly is more to do, as is the nature of home improvement, but having a finite list of things to accomplish and making time to enjoy them made all the hard work worth it! Here is my top ten list of how to make the most of your time when tackling home-improvement projects.

This weekend I spent the greater part of Saturday taking care of the ongoing household to do list and the transformation made a huge impact. There certainly is more to do, as is the nature of home improvement, but having a finite list of things to accomplish and making time to enjoy them made all the hard work worth it! Here is my top ten list of how to make the most of your time when tackling home-improvement projects.

1. Imagine your perfect place. Your home should reflect your personality, the way you spend your time, and fit your needs. If you want a place to entertain, to relax and meditate, to create art, nurture your children, or display your collections, you will want to consider your priorities. Once you have explored the possibilities the next step is to prioritize your to-do list in order to make the most impact.

2. Make a list. Some home project lists could go on and on (and on), so it’s a good idea to write out a list and discuss the details with the members of your household so you know where to start and who is responsible for what.

3. Prioritize. Once you know what needs to be done it’s time to prioritize the list. If there is something timely (like getting gutters before the fall) keep that in mind when prioritizing, but also think about those projects that will bring you the most joy in daily life.

4. Do one project that really makes a difference. I recently finished sprucing up the living and dining rooms with new curtains and new furniture for storage and display. These are the rooms I spend the most time in at home, so the difference is palpable to how I view my home. Now we are ready for a big dinner party which is one of the most important things in our household. From this experience, I realized that small changes and some cleanup can make a huge difference.

5. Keep it reasonable. Make sure your list is reasonable. The goal isn’t to get everything done in one weekend, which typically isn’t feasible anyway. Rather, you want the time you invest in your home to be enjoyable and give you the sense of satisfaction (and motivation to do more).

6. Gather your tools. Nothing will derail a project like not having the right tools. Once you know what you are going to accomplish make sure all your supplies are ready. You’ll be far more efficient if you hit the hardware store, fabric store, gas station, etc. prior to getting started.

7. Work together. Some projects are two-people projects. If you share your household, enlist other members to share the work. Some projects need two people to lift, spot, hand tools, push, pull, etc. If you live alone, have a work party by inviting a friend over to help. You can return the favor if they ever need help with a household project.

8. Enjoy the process. Blast music, take breaks, and step back to reflect on your household improvement. If you need to dedicate a weekend to doing your chores, you may as well still enjoy it!

9. Get the list done. If you’ve taken the time to make your list reasonable you shouldn’t have any trouble completing it. Doing so will reaffirm your sense of accomplishment, so when you look at what was done, you won’t be thinking about what you have to do next.

10. Bask in your success. Focus on the improvement, enjoy your space, and most importantly, use it! If you made your bedroom a sanctuary, light a candle and relax with a good book. If you reconfigured your kitchen for more efficient use, have your own Iron Chef moment and cook a huge meal. Just remember, all your planning and hard work should be enjoyed.

What are your tips for making the most out of your home?

For more information on Windermere Evergreen, please contact us here.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link